Disclaimer | Kontora KVG

Welcome to the website of Kontora Kapitalverwaltungsgesellschaft (Kontora KVG). In order to provide you with relevant information about our product range, we ask you to select your customer classification and the country in which you are based or from which you are accessing our website.

By clicking on the “Confirm” button, you confirm that you have made the above selection correctly and that you have understood and accepted the information on the Disclaimer / Data Protection Policy of Kontora KVG.

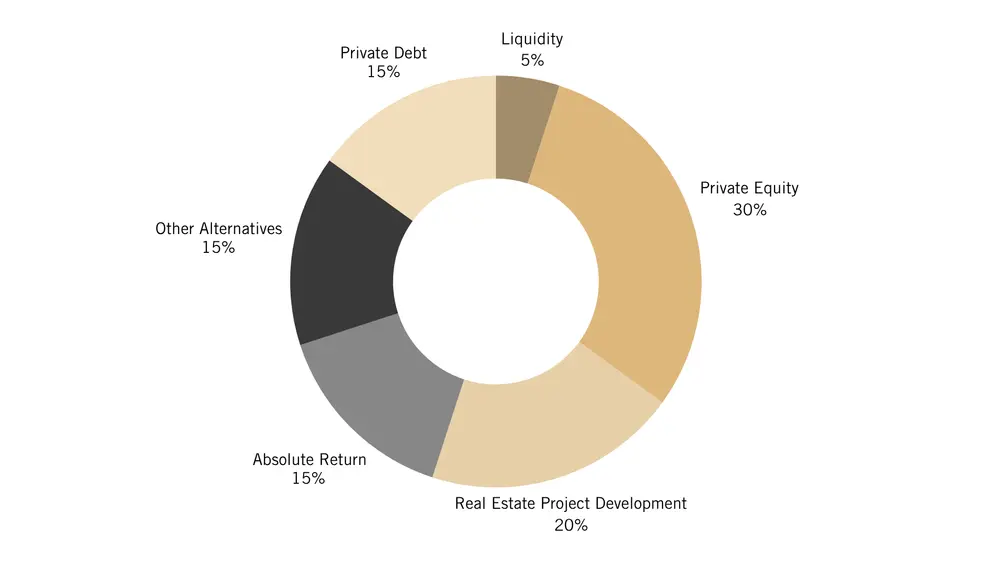

Clarius Private Markets

The Clarius Private Markets fund invests in various asset classes, in particular in private equity, real estate development, private alternatives, private debt, and absolute return. The fund aims to promote environmental and/or social characteristics through its investments. To this end, the fund non-bindingly strives to invest 65% of its target investments with a minimum score of 2.0 according to the ESG scoring procedure of Kontora Kapitalverwaltungs GmbH.

The assessment of environmental and social characteristics is based primarily on the United Nations Sustainable Development Goals (SDGs) and their sub-goals. In addition, compliance with the principles of good corporate governance is assessed on the basis of criteria such as tax compliance, written rules, strategy system, reporting, and remuneration policy.

For detailed information on the ESG characteristics of Clarius Private Markets, please refer to the document linked here in accordance with Art. 10 of the Disclosure Regulation.

Basic Data

Trade Information

Target-Allocation "Clarius Private Markets"

Fondsmanager

Portfolio Manager